Friday, May 06, 2005

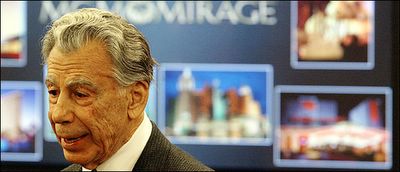

Joe Cavaretta/Associated Press

Kirk Kerkorian is offering to buy shares in General Motors. He tried to take over Chyrsler in the 1990's.

May 5, 2005

Kerkorian Seeking 9% Stake in G.M.

By DANNY HAKIM

DETROIT, May 4 - Kirk Kerkorian, the multi-billionaire casino operator and financier, said today that he was making an offer that would give him a stake worth nearly 9 percent in General Motors, the struggling Detroit auto giant whose stock recently hit a 12-year low. Coming from Mr. Kerkorian, an 87-year-old with a history of taking big stakes and exerting varying degrees of control over airlines, casinos, automakers and movie studios, the news surprised Detroit and Wall Street.

G.M. shares surged 18 percent, closing at $32.80, up $5.03.

Mr. Kerkorian's investment firm, Tracinda, said in a statement today that its acquisition was "solely for investment purposes." But Mr. Kerkorian has been known as an investor who rarely sits on the sidelines, asserting his will on the often struggling companies he buys in hopes of turning them around. He previously was Chrysler's largest shareholder and tried unsuccessfully in the 1990's to take over the company with the aid of its former chairman, Lee A. Iacocca. He is now in the midst of a legal battle with DaimlerChrysler over the terms of the 1998 merger between DaimlerBenz and Chrysler.

In an interview Wednesday morning, Mr. Kerkorian's personal lawyer, Terry Christensen, said the investment would be a passive one and added that Mr. Kerkorian would not seek a board seat or control over management. He also said that Mr. Kerkorian aimed for an investment of roughly 9 percent and was not looking for a larger stake at present.

And he said that Mr. Kerkorian had confidence in G.M.'s management, including the chairman and chief executive, Rick Wagoner.

"He's not really trying to judge management," Mr. Christensen said. "He's trying to judge the assets of the company, the ability of the company to right itself and get going strong again. He sees no reason why this management team can't do that. He believes they will do it."

But people on Wall Street and in Detroit say they are skeptical that Mr. Kerkorian would make a passive investment. Analysts floated several possibilities: Mr. Kerkorian would press G.M. to sell some of its lucrative non-automotive business, like its mortgage lending business; he would eventually try for various degrees of management control; or he would make himself enough of a nuisance that G.M. would buy his shares for a quick profit, a tactic he has used with companies like Columbia Pictures.

"Our expectation is that the Tracinda/G.M. story will take many twists and turns over many quarters," said John Casesa, an analyst at Merrill Lynch, who upgraded his rating on G.M. shares to neutral from sell after the announcement. "We expect G.M. to react vigorously and defiantly to Tracinda's actions. Given G.M.'s still considerable economic and political clout, we expect this to be a long, drawn-out battle."

"Given Kerkorian's successful track record of unlocking shareholder value, we feel we cannot continue to be a seller of G.M.," he said, adding that he thought Mr. Kerkorian might be interested in having G.M. sell or consider other options for the nonautomotive businesses, like its mortgage lending unit, that are part of the General Motors Acceptance Corporation, G.M.'s financing division.

Tracinda, which is owned by Mr. Kerkorian, said Wednesday that it had bought 22 million shares, or 3.9 percent of G.M., in the last few weeks. Tracinda said it was also offering $868 million, or $31 a share, for 28 million more G.M. shares. The offer represented a premium of 11.6 percent over G.M.'s closing price of $27.77 on Tuesday.

Mr. Christensen said Mr. Kerkorian thought G.M. had been oversold by the market and saw the investment as "a value investing play."

"Mr. Kerkorian's focus has always been, what are the assets of the company and what is the ability of the company to generate cash flow and to strengthen its position in the marketplace?" he said. "General Motors, he believes, has the assets and the cash flow, and the ability to generate more cash flow. Over time they have proven themselves to be an extremely strong competitor and he believes they will continue to prove that to be the case."

In a statement. G.M. said it learned about the offer today and would "not express a view on specific investor activity."

Born in Fresno, Calif., Mr. Kerkorian is the son of Armenian immigrants. He spent his youth boxing, among other things, and during World War II was a pilot who trained other pilots for the military. He built the charter airline Trans International in the 1960's, then sold it, bought it back and sold it again, and went on to develop hotels and casinos in Las Vegas.

Over the last half century, he has bought and sold Metro-Goldwyn-Mayer, the movie studio, three times, most recently last year, for a handsome profit. Shares of his MGM Mirage casino group have risen more than 50 percent in the last year, driven in part by its acquisition of the Mandalay Resort Group.

A less successful investment has been his stake in Chrysler, which depreciated considerably after the merger with DaimlerBenz. Mr. Kerkorian is suing DaimlerChrysler on the ground that he was misled about the terms of the merger, but a federal judge rejected that argument this year. Mr. Kerkorian is appealing.

Mr. Christensen, the lawyer, declined to offer specifics about what particular assets attracted Mr. Kerkorian to G.M.

"This is an endorsement of the American automobile industry and General Motors specifically," he added. "It is an endorsement of the industry and its future."

Gerald Meyers, a professor at the University of Michigan who was the chief executive of American Motors before it was sold to Renault in the 1980's, said the likely outcome would be for Mr. Kerkorian to force G.M. to buy out his shares.

"He's not going after the company," he said. "G.M. is not going to be well anytime soon and he knows that."

"The only thing I can make out of it is that he hopes he'll be bought out or that he truly will be patient and will wait for the stock to go up, which I can't imagine he can find on the horizon."

Certainly, G.M. is in rough shape. Last month, the company reported a $1.1 billion first-quarter loss, its largest quarterly loss in more than a decade, and the company has been pummeled this year by falling sales in the United States, particularly for large sport utility vehicles. Rising health care costs have also hurt; G.M. is the nation's largest private health care provider, giving coverage to 1.1 million American workers, retirees and their families. The array of problems have raised questions about G.M.'s long-term viability, though most analysts say it has adequate cash reserves to stave off a bankruptcy filing.

Copyright 2005 The New York Times Company Home Privacy Policy Search Corrections RSS Help Contact Us Back to Top